IT, consulting, and wholesale trade: over 25.5 thousand Ukrainians are company owners in the United Kingdom

According to UK Companies Registry (by Companies House) records, more than 26.6 thousand UK-registered companies list approximately 25.5 thousand Ukrainians as their owners or ultimate beneficial owners. YouControl analysts found that Ukrainian directors and business owners are most heavily represented in the technology sector. Other key industries and the resilience trends of businesses with Ukrainian participation in the UK are examined in a joint study by Roman Kornyliuk, YouControl financial analyst, professor at KNEU named after V. Hetman and the YouControl R&D Centre.

The scale of Ukrainian business presence

The United Kingdom has long been considered one of the most attractive destinations for international entrepreneurship, owing to its transparent legal framework and access to global capital markets. Recent analytics from the YC World tool (as of November 2025) reveal a substantial Ukrainian presence in the UK Companies Registry (by Companies House), reflecting a high level of entrepreneurial activity among Ukrainians in the UK market.

Specifically, the UK Companies Registry (by Companies House) contains more than 28.5 thousand records for companies and approximately 24.9 thousand records for individuals who are or have been company directors and are Ukrainian citizens. These figures underscore the role of Ukrainians as corporate leaders capable of integrating into and operating under Western management standards.

In parallel, ownership-related statistics are equally significant. The UK Companies Registry (by Companies House) includes 26.6 thousand company records with around 25.5 thousand Ukrainians listed as ultimate beneficial owners. This highlights not only managerial involvement but also substantial Ukrainian ownership participation in the British business environment.

A closer examination of company statuses reveals a dynamic and diverse picture, ranging from actively operating enterprises to businesses that have completed their operational life cycles.

Company status distribution (directorship vs ownership)

What do these figures reveal?

- Operational resilience. More than 14.6 thousand UK-registered companies with Ukrainian ownership remain actively operating. This demonstrates that a significant volume of Ukrainian capital and entrepreneurial initiatives has been effectively integrated into the UK economy.

- Natural market rotation. The high number of dissolved companies represents a standard market dynamic in the United Kingdom, where the processes of company registration and closure are relatively simple. In many cases, this reflects the completion of time-bound projects or the restructuring of strategic assets rather than business failure.

- Exceptionally low insolvency rates. The minimal share of companies in liquidation (below 0.5%) indicates that Ukrainian entrepreneurs largely avoid debt accumulation and prefer to exit the market through orderly, voluntary liquidation rather than compulsory insolvency procedures.

UK businesses under Ukrainian management: a hybrid model of local presence and remote control

The jurisdictional distribution of Ukrainian directors in UK-registered companies highlights a clear hybrid management model that combines physical presence in the United Kingdom with active remote governance from Ukraine. The largest share of directors is registered under British jurisdiction (48.3%), reflecting a high degree of integration of Ukrainian professionals into the UK business environment, where they act as residents directly overseeing operations on site. The second-largest segment comprises directors registered under Ukrainian jurisdiction (38.4%), underscoring the practicality and effectiveness of managing UK-based assets directly from Ukraine. Smaller but notable concentrations of directors in Poland (3.2%) and Germany (1.4%) mirror the broader patterns of Ukrainian business migration across Europe, with these countries functioning as intermediate hubs for the administration of international corporate structures. Additional jurisdictions – including Spain (0.7%), the Czech Republic (0.6%), Italy (0.4%), and the United States (0.4%) – illustrate the global dispersion of Ukrainian management talent. The presence of directors in the UAE (0.4%) is likely linked to business process optimisation and engagement with international financial centres.

An analysis of Ukrainian directors’ declared roles in UK companies provides insight into patterns of professional self-identification. It is important to recognise that UK company registration allows individuals to define their own job titles or occupations, which accounts for the wide variety of descriptions observed.

Overall, the UK Companies Registry (by Companies House) is characterised by a predominance of formal role designations (57.7%). The majority of Ukrainian directors opt for standard legal titles, most notably Director (36.9%) and Company Director (20.8%). Combined, these two categories represent more than half of all recorded entries. These titles traditionally denote individuals who carry legal responsibility for corporate governance. The preference for the term Company Director often suggests a more formalised approach to business structuring or the use of professional incorporation services.Simultaneously, the UK Companies Registry (by Companies House) shows a pronounced entrepreneurial self-identification among CEOs with Ukrainian citizenship, at 7.7%. A considerable share of Ukrainians describe themselves through their membership in the business community rather than purely as corporate administrators: Businessman (2.5%), Business Person (2.2%), Entrepreneur (2.2%), and Businesswoman (0.8%). The relatively high combined proportion of “entrepreneurs” and “businesspeople” emphasises the hands-on role owners play in the daily operations of their companies. The distinct listing of Businesswoman (174 individuals) further underscores the growing visibility of female leadership within the Ukrainian business diaspora.

Titles linked to top-level management and strategic governance represent 2.3% of Ukrainian directors in the UK Companies Registry (by Companies House). The adoption of globally recognised corporate titles is characteristic of companies with scaling ambitions, with CEO (1.2%) and Managing Director (1.1%) most commonly used. Selecting these designations typically signals a more sophisticated governance structure or an effort to position the company as a contemporary international startup or corporate entity.

In addition, a segment of directors identifies themselves through professional or service-based roles (4.4%), such as Manager (2.6%) – a designation that may indicate either operational line management or specific functional responsibilities – and Consultant (0.9%). This reflects a substantial cohort of Ukrainians delivering professional services, including IT consulting, legal, or financial advisory work, while leveraging UK-registered companies as a formal legal framework for their expertise.

Ukrainian entrepreneurs in the UK market: IT, consulting, wholesale trade, and advertising agencies

More than 45% of the records in this sample of owners of corporate rights in British companies with Ukrainian citizenship belong to individuals from Ukraine. This figure surpasses the share attributed to UK jurisdiction (42.5%). Combined, the two dominant jurisdictions – Ukraine and the United Kingdom – account for nearly 88% of the companies in the dataset. The remaining eight jurisdictions together account for only around 7%. Among these, EU countries dominate, with Poland, Germany, and Spain leading – an outcome consistent with geographic proximity and long-standing trade relationships. The appearance of the UAE and Cyprus among the top jurisdictions suggests the use of UK entities within more sophisticated international corporate structures, where the UK functions as a jurisdictional “facade” for businesses managed from established global financial centres.

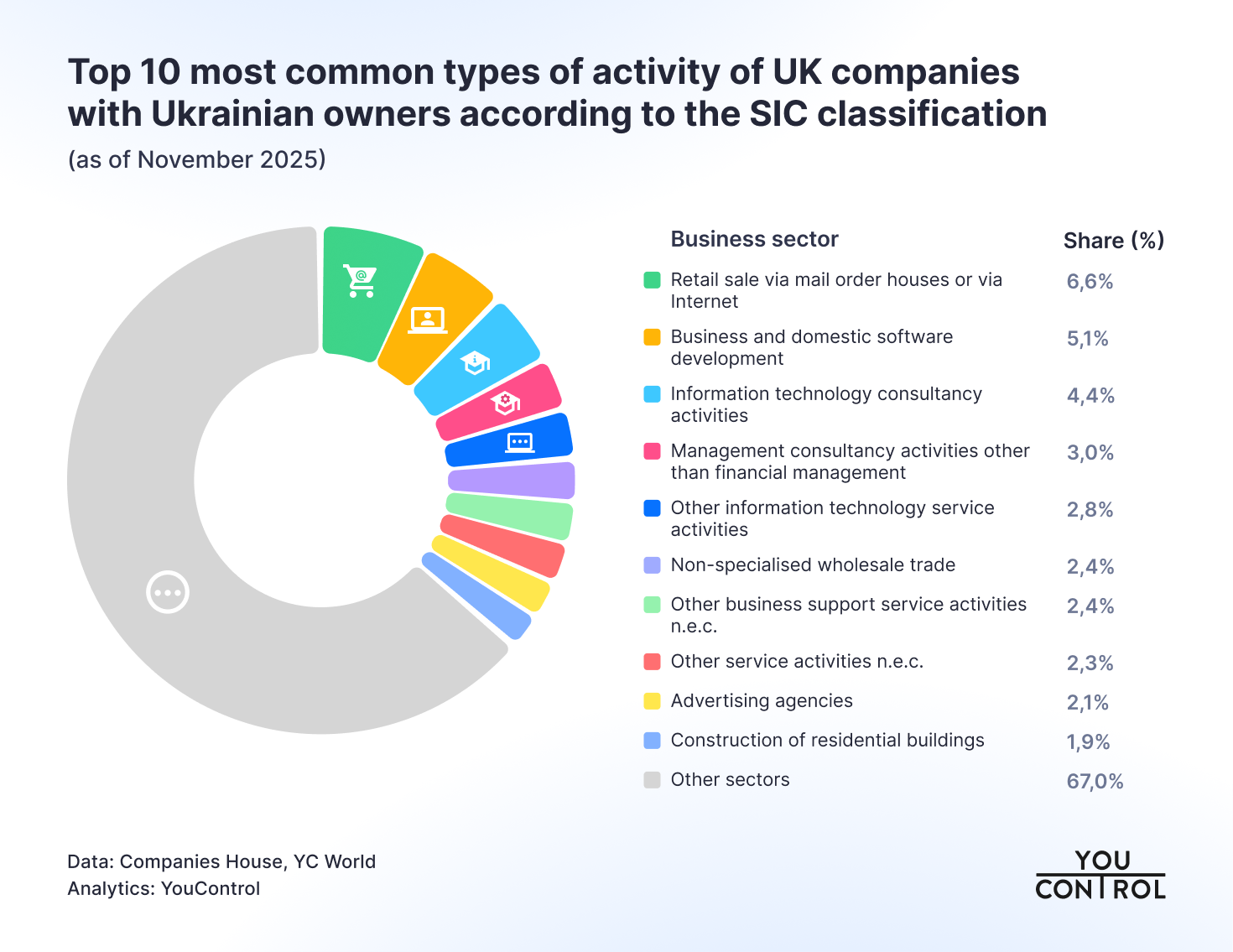

The sectoral analysis of UK companies owned by Ukrainians reveals a pronounced emphasis on the digital economy and professional services. The largest segment is online and mail-order retail trade, which accounts for 6.6% of all companies (3,079 entities)

A significant portion of activity is concentrated in the technology sector. Software development for business and consumer applications accounts for 5.1%, while IT consultancy and other information technology activities add a further 4.4% and 2.8%, respectively. Taken together, these categories make IT the most powerful and consolidated area of Ukrainian business presence in the UK. Intellectual capital is also strongly represented through management consulting (3%) and advertising agencies (2.1%). Commercial activity is complemented by non-specialised wholesale trade, which accounts for 2.4%. The services sector includes auxiliary business services (2.4%) and other personal services (2.3%). The top ten industries include residential construction, which accounts for 1.9% of enterprises. Despite the concentration in these leading areas, the majority of Ukrainian-owned companies operate across a wide range of other industries, underscoring the high degree of diversification and adaptability of Ukrainian businesses to diverse segments of the UK market.

From risk awareness to ethical action: how open data is shaping responsible business

In international business operations and cross-border cooperation, understanding the potential risk factors associated with counterparties is essential. Such areas of heightened scrutiny must be evaluated judiciously when making strategic decisions about markets and partners. Companies that focus exclusively on commercial activity and profit maximisation should be prepared for significant reputational and financial repercussions. By contrast, organisations that prioritise ethical conduct are expected to place corporate social responsibility, transparency, and integrity above short-term financial gain.

Open data–driven tools play a critical role in identifying latent risks, enabling evidence-based decision-making, refining strategic approaches, and ultimately contributing to the development of a global culture of business integrity. One such solution is YC World, an international platform for the search and visualisation of business relationships worldwide. It facilitates the discovery of hidden insights, supports comprehensive counterparty due diligence, enables continuous monitoring, and allows users to build investigative projects by integrating system data with proprietary information. Completed investigations can be stored and exported for subsequent analytical or operational use.

The automation of relationship mapping substantially reduces the time required to analyse complex investigative cases, allowing analysts to concentrate on interpreting findings rather than on data collection.

YC World is an international analytical platform designed to visualise and map connections between companies, delivering deep analytical capabilities and supporting informed business decision-making. The platform aggregates data on individuals and legal entities from more than 350 sources across over 80 countries, including 40 national public registries such as those of Germany, Poland, France, Spain, and Luxembourg. In addition, the system incorporates dozens of supplementary datasets, including newly introduced national sanctions lists, registers of politically exposed persons, and detailed information on Russian PEPs, state institutions, and banks. YC World enables the identification of ultimate beneficial owners, the assessment of links to PEPs, the verification of sanctions exposure, and the detection of additional connections through assets and accounts across more than 246 million mapped relationships. The solution is part of the YouControl portfolio of analytical tools.

Check your business partners comprehensively with YC World.

Schedule a demo to see how the solution supports in-depth due diligence and risk analysis.